Restaurant Accounting Software Free Download

Restaurant accounting software free downloads Restaurology Restaurant Point Of Sale 9.0 Restaurology The science of running a restaurant Full Service, Fast Food, Casual Dining, Walk-up, Drive Thru, Take Out, and Delivery Concepts.

Top 4 Download periodically updates software information of restaurant accounting software full versions from the publishers, but some information may be slightly out-of-date. Using warez version, crack, warez passwords, patches, serial numbers, registration codes, key generator, pirate key, keymaker or keygen for restaurant accounting software license key is illegal. Download links are directly from our mirrors or publisher's website, restaurant accounting software torrent files or shared files from free file sharing and free upload services, including Rapidshare, MegaUpload, YouSendIt, Letitbit, DropSend, MediaMax, HellShare, HotFile, FileServe, LeapFile, MyOtherDrive or MediaFire, are not allowed! Your computer will be at risk getting infected with spyware, adware, viruses, worms, trojan horses, dialers, etc while you are searching and browsing these illegal sites which distribute a so called keygen, key generator, pirate key, serial number, warez full version or crack for restaurant accounting software. These infections might corrupt your computer installation or breach your privacy.

Restaurant accounting software keygen or key generator might contain a trojan horse opening a backdoor on your computer.

While recent studies have shown that the restaurant industry has grown in the past few years, the fact remains that about close within their first year of business. There are, of course, any number of reasons why a new restaurant may be forced to shut its doors, but certainly one of the most vital elements of running a successful company is keeping the books. Choosing the right to help you do that can be overwhelming, to say the least. There are a ton of accounting systems out there, each with myriad features and applications available for customization. Big bang bad boy free mp3 download.

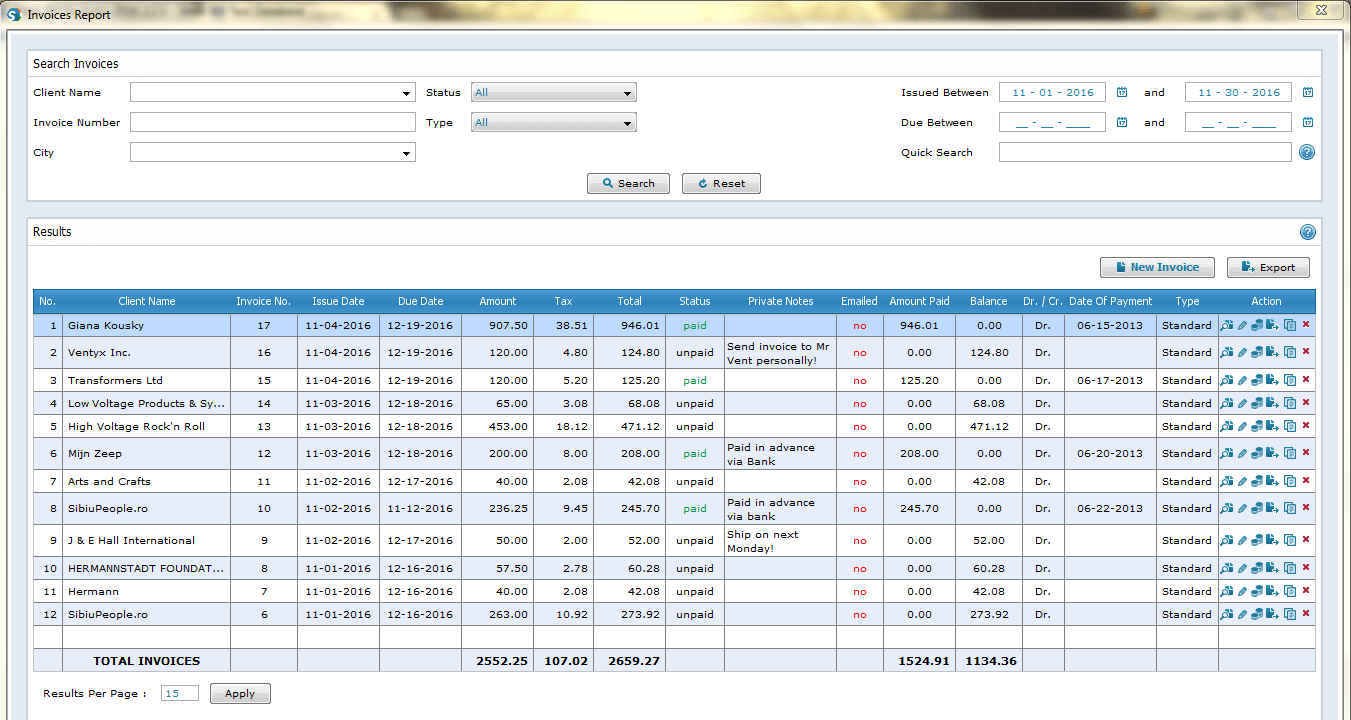

That's why it's important to know the basics about restaurant accounting software before you begin your search for the system that best fits your needs, whether you're tracking payments, payroll or produce. Here's what we'll cover: What Is Restaurant Accounting Software? Running a restaurant means keeping up with a lot of things, not the least of which is expenses. Fortunately, a good accounting system specifically geared toward your industry can alleviate much of this work by managing every aspect of your business's finances. Most restaurant-specific accounting systems offer the following modules: • • Billing • Inventory management • Purchase orders Essentially, restaurant accounting software will offer the same modules as general accounting systems, but the functionality will be more directly tailored to restaurant management. Most restaurant bookkeeping software offers integration with other systems, such as point of sale (POS) and tax management or expense tracking and payroll. Payroll overview in Common Functionality of Restaurant Accounting Software Expense tracking Tracks every dollar spent—from the purchase of ingredients for recipes to the cost of keeping the lights on.

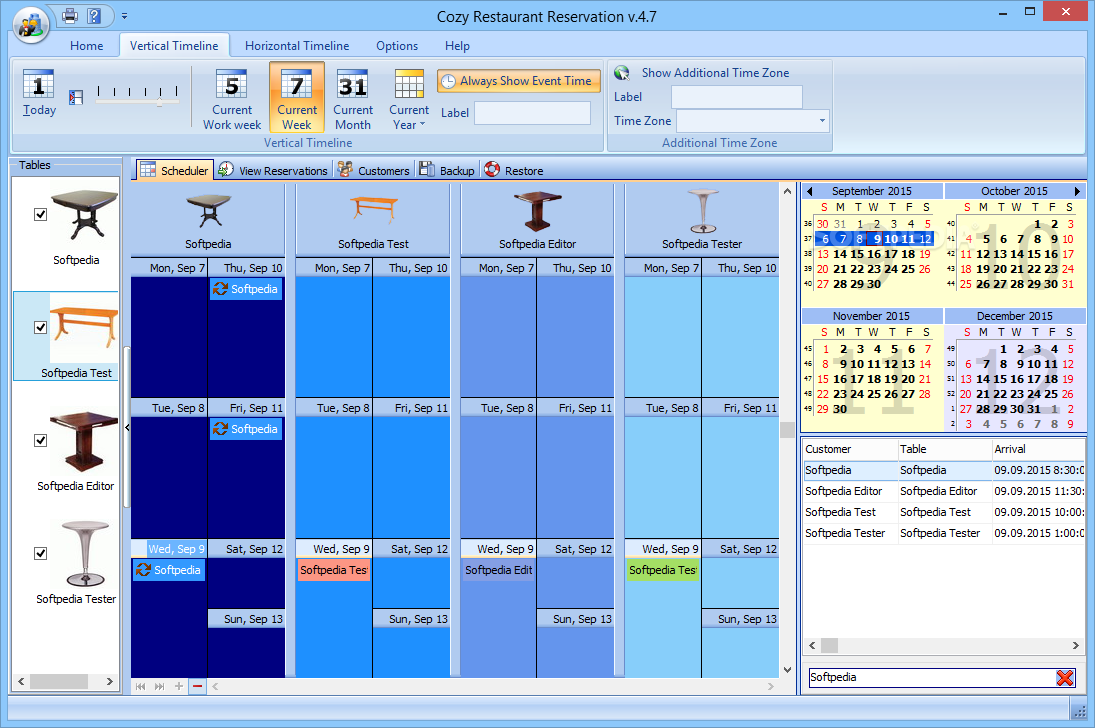

This function ensures business owners or managers won't miss anything, so that the books will always be balanced at the end of the quarter and there won't be any surprises when tax season arrives. Ensures businesses comply with the and tracks what a business spends on ingredients or supplies in order to provide a comprehensive report of where money goes. Inventory tracking software is especially important for restaurants because it can save money by preventing over-ordering and help chefs plan menus according to the availability of ingredients. When integrated with restaurant-specific software, POS systems help servers calculate bills with state tax, incorporate tips, adjust inventory and print receipts. Some systems work with tax reporting modules to automatically produce filled-out government documents. Some systems offer their own payroll tracking capabilities, while others are designed to work with stand-alone payroll software.

Either way, having a reliable system in place allows restaurant managers to keep track of employee hours, automatically calculate payments and cut checks, cut down on human error and generate employee tax documents such as 1099s or W-4s. Prevents managers or restaurant owners from having to manually code data in order to see where money is going. Reporting tools can provide specific sets of information to provide as narrow or broad a view of a business's finances as is necessary.